We help brands drive internal capability, operational and executional improvements to achieve excellence in brand, creative and e-commerce strategy execution. Providing services and solutions across strategy management, internal enablement, capability building and executional support provision.

Flagship clients

(EMEA) 14 markets

(EMEA) 14 markets

(EMEA) 47 markets

(EMEA) 47 markets

(EMEA) 17 markets

(EMEA) 17 markets

(WHQ)

(WHQ)

Even though for the past couple of years media headlines have been championing rapid growth D2C start-ups and traditional, wholesale model, organisations' ventures into direct-to-consumer channels, an undeniable fact remains that most of the online sales happen and will continue to happen through non-owned or indirect eCommerce properties. While some have even prophesied 'the death of wholesale' and 'death of the middleman' fact remains that you will never be able to sell directly as much as you'll be able to sell through partners. D2C prioritisation and (over)reliance might work, and up to a point, for well established, one of a kind, global brands who dominate their industries.

You will never be able to sell directly as much as you'll be able to sell through partners

The Indispensable Role of Partner eCommerce

Even those, such as Nike who takes up a lot of media articles for its winning direct to consumer model, still get most of their revenue from their wholesale channel - 65% in 2020. Though the share of wholesale channel sales has been been declining significantly from 2012 (83%), one needs to know that Nike as a brand became what it is today because of its wholesale partners. Back in the days, when they were an unknown company and a brand, it was the wholesale partners and retailers who provided critical revenue life line and provided financial guarantees (future orders) based on which Nike (then Blue Ribbon Sports) was able to get lines of credit to finance purchase from overseas partners.

Achieving brand recognition and scale for a young or mid tier brand is almost impossible with just a D2C channel.

Achieving brand recognition and scale for a young or mid tier brand is almost impossible with just a D2C channel. This became even more true with rise of cheap venture capital fuelled and (only revenue, not profit) growth imperative D2C start-ups who, bidding against each other for clicks, made costs of (digital) consumer acquisition (CAC) skyrocket. As thousands of venture capital based SaaS companies normalised loss-making for their shareholders, they've also in the process made D2C a game reserved only for those with deep digital marketing pockets.

Rise of cheap venture capital fuelled and (only revenue, not profit) growth imperative D2C start-ups made D2C a game reserved only for those with deep digital marketing pockets

Partner eCommerce (3rd party / marketplaces, eRetailers and Pure-players) is a vital if not most important element of digital go-to-market model for many if not most consumer brands. Retail.com partners, in whichever form or business model, provide an indispensable market access at a scale and within a time-frame impossible to be matched by direct-to-consumer channel. Some of many benefits are positive cashflow impact, financial and operational scale, access to new markets and customers and brand awareness building.

Retail.com partners, in whichever form or business model, provide an indispensable market access at a scale and a time-frame impossible to be matched by direct-to-consumer channel.

However, like most things, aside of benefits, partner eCommerce also has its disadvantages. Perhaps two biggest downsides of indirect retailing, whether it takes form through physical or digital channels are price discounting tendencies and inability to meet & foster unique brand differentiators - the commoditisation effect it has on already established brands.

Price Discounting and Brand Commoditisation in Partner eCommerce

External or market drivers of discounting & brand commoditisation

Even though price discounting tendency in (indirect) retail isn't just a challenge of our day and age, nor it was brought about or just present in e-commerce, one could argue that events in recent, technology driven, societal developments have amplified and fast-tracked it. Information access democratisation established radical price transparency, while digital technology enabled easier and faster market access to challenger brands. This in turn increased mark-down pressures for many traditional retailers who often forfeit(ed) profit margins for sake of market share safeguarding. Succumbing to discounting pressures was especially a prevalent response of an undifferentiated, 'physical-first-digital-second' retailers, whose market value proposition was suddenly upended. On one side they were pressured by larger, but more efficient, new business model platforms led by Amazon, and smaller, but more differentiated, specialty retails or niche brand D2C players on the other. Discounting practice incentives were amplified by the rise of e-commerce channel because of its core alignment with underlying, technology enabled, marginal cost economics of the business model.

Discounting practice incentives were amplified by the rise of e-commerce channel because of its core alignment with underlying, technology enabled, marginal cost economics of the business model.

Marginal costs of virtual stocking enables e-commerce outlets to pursue minuscule or at times negative margins which, applied at a scale, with capability of 'endless' virtual aisle of products, stimulate mark-downs for sake of market-share & sell-outs. Digital customers' stickiness and customer life-cycle value (CLV) perspective, combined with almost free CRM enabled targeted consumer communication, also makes discount or even loss making (first) sales a plausible market strategy. Last, but not least, compared to traditional retailers, e-commerce only or 'pure-players' usually tend to have a much lighter organisational cost structure, which enables and stimulates them to pursue discounting as a market practice.

.jpeg)

Aside of discounting, the technology, which sits at the core of its business model and value proposition, is also responsible for another negative side-effect of partner e-commerce : commoditisation of established brands on partner properties. This is especially true for large engines and e-commerce players like Google and Amazon which can seriously harm brands as they reduce them to comparison based on features, functionalities and price, instead of your brand. Partner eCommerce / eRetail environments are in practice just big catalogs (many of them pretty ugly ones) which enable consumers to browse / search / compare offerings on standardised set of criteria. Biggest ones like Amazon most often place competitor offering right next to yours in form of suggestions based on search algorithms which are optimised for conversion / sell-through / retailer's revenue growth (disregarding of which brand).

Many established brands, in search of e-commerce partnership growth, may feel like having to chose between two evils - declining sales or declining brand equity.

Technology conditioned standardisation is an antithesis of brand differentiation. This is why many premium brands, even complete industries (such as luxury) were hesitantly dragging their feet to enter e-commerce. Both direct and even more so the indirect one. Now, as global pandemic has irrevocably plunged every industry and consumer consumption facet into digital first dimension, many established brands, in search of e-commerce partnership growth, may feel like having to chose between two evils - declining sales or declining brand equity.

It shouldn't come as a complete surprise to think of price discounting and brand commoditisation in partner e-commerce as two sides of a same coin. Discounting and brand commoditisation not only complement, but augment each other, creating a vicious circle and a downward spiral. Ultimately, after being stripped of its unique differentiations, brand is left to mercy of comparison based e-commerce algorithms.

After being stripped of its unique differentiations, brand is left to mercy of comparison based e-commerce algorithms.

Internal or channel (mis)management drivers of discounting & brand commoditisation

However, the causes of brand commoditisation and price discounting in partner e-commerce can't always be blamed on technology infused market driven causes. Quite often, these negative externalities of partner e-commerce are amplified by poor or lack of proper channel management practices. Namely, many brands in search of rapid e-commerce revenue growth, approach both selection and management of their e-commerce partners in an 'one size fits all' approach. One of major mistakes of engaging in partner e-commerce is to disregard product assortment strategies and practices. Even though it might be tempting to think both brand and revenue growth will come by stocking all of your partners with all of your product categories & variants, this, essentially flawed thinking, will actually decrease your overall channel profitability and trigger partner and product cannibalisation - which will drive discounting and brand commoditisation.

Many brands in search of rapid e-commerce revenue growth, approach both selection and management of their e-commerce partners in an 'one size fits all' approach.

Sri Ganesh Santhiram, an EMEA senior e-commerce leader, who headed e-commerce of Fossil Group, global digital marketing for Victorinox AG and now launching and growing EMEA direct-to-consumer business for US based Cricut - a smart cutting machine, summarises the problem. "The danger of price discounting and commoditisation is exasperated by brands nothing having a clear idea of how to enter markets with 3rd party retailers, coupled with their own DTC eCommerce growth ambitions. This leads spending more time and resources in internal alignments (on promotional cadence etc.) than on the vision for growth and building brand equity. Having a clear idea on how to differentiate product offerings and segment retailers, would go a long way in helping brands capitalise on the potential of e-retail.”

Before in the 'physical' only partner retail market - assortment issue / cannibalisation which triggers discounting - technology aided price matching between retailers, wasn't an issue as most of the retailers competed on physical location. So lets say you had a X partner in city A, and Y partner in city B. Even thought they would stock the same items X and Y partner were not really a competitor to each other as search costs (for any deals) would be too great for an individual customer to bear ( for example to go from city A to city B in a search of a better deal). Plus, there was no immediate visibility of prices of other retailers (in city A, B). With partner e-commerce however, that changes, as online, both your partners' stock and prices become transparent and immediately available to online consumers, not just within and across cities and countries, but also across national borders. Without having a proper assortment strategies and tactics in place you are essentially turning your retail partners into competitors. Not just among themselves, but also with your D2C channel.

Without having a proper assortment strategies and tactics in place you are essentially turning your retail partners into competitors. Not just among themselves, but also with your D2C channel.

The "one size fits all' approach or stocking all of your partners with all or almost all of your products will also most likely make your e-commerce partnership channel less profitable. Even though virtually stocking your partners on the surface may seem entirely costless for you, leading you to think that quickest path to revenue growth and profitability is to make everything available everywhere, this is actually not true. While there may not be costs of additional (virtual) stocking of your 3rd party partners, the fallacy of this thinking and approach to partner e-commerce lies in the opportunity costs of forgone sales.

Stocking all of your partners with all or almost all of your products will also most likely make your e-commerce partnership channel less profitable

Namely, all sales have some associated costs, whether its in acquisition costs, sales processing, product delivery costs or costs of missed sales of same category, but higher margin product. If you sell an item A in your partner e-commerce property, while on surface a good result by itself, it may also have been an opportunity missed to sell product B, which has same functionality, but higher margin, thus brings more profit.

Without a 3rd party e-commerce strategic assortment in place, the opportunity costs will inevitably grow, making your channel less profitable than it could have been.

Without a 3rd party e-commerce strategic assortment in place, the opportunity costs will inevitably grow, making your channel less profitable than it could have been.

Turning Partner E-commerce Into a Brand Equity Building Tool

However, the partner e-commerce growth and digital brand equity trade off does not have to be a binary choice. Organisations with strategic understanding of : a) brand equity building pillars, b) partner e-commerce media value potential, c) underlying sources of e-commerce growth and d) importance of assortment strategies in 3rd party commerce will have the ability to create an alternative go to market model methodology, which will amplify the positive effects of partner e-commerce, while curtailing the negative ones.

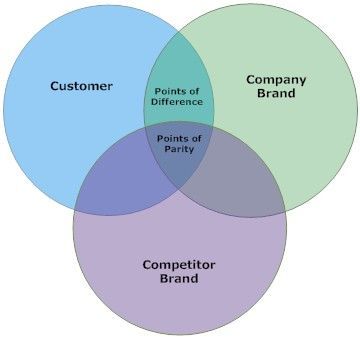

a) Pillars of Brand Equity

Customer based brand equity occurs when the consumer has a high level of awareness and familiarity with the brand and holds some strong, favourable and unique brand associations in memory. Brand awareness as the consumer's ability to identify (recognise or recall) the brand within the category, in sufficient detail to make purchase. Brand image is the set of beliefs, ideas, and impression that a person holds regarding an object. Brand positioning is the act of designing the company's offering and image to occupy a distinctive place in the mind of the target market. In simpler words, brand positioning describes how a brand is different from its competitors and where or how it should be placed in customers' minds.

Brand positioning sets the stage and frame of reference for activities that aim to build brand awareness and brand image. Brand positioning is established through definition and communication of the competitive frame of reference which influences the type of creation of both points-of-parity (POP associations) and points-of-difference (POD associations). POP are attribute or benefit associations which are not necessarily unique to the brand but may in fact be shared with other brands. POD are attributes or benefits that consumers strongly associate with a brand, positively evaluate, and believe they could not find to the same extent with a competitive brand. It is because of these beliefs, established through relevant points of differentiation (POD), that consumers are willing to pay full and premium prices. Thus, strong brand equity, and well communicated POD (points of differentiation) are crucial enabler of premium pricing and full price sales.

b) Media Value of Partner E-Commerce Stores

In an attempt to properly valorise the contribution of physical retail stores to overall retail business and brand, one of the prominent authors on retail transformation, Doug Stevens, argues that physical stores should be measured not only by traditional industry metric of sales per square meter, and that the key metric or a physical store should be its media value - on the immersive brand experience it provides. While I won't get into details of his extremely valid argumentation (you can read it here), fact remains that, sales as the sole metric do not capture the full value of brands presence and visibility across both physical and online stores. If the average conversion rates for e-commerce stores across industries ranges between 1-2%, one can reasonably ask what is the value of the remaining 98% of consumer visits / views / impressions to your online store or brand / product pages?.

If the average conversion rates for e-commerce stores across industries ranges between 1-2%, one can ask what is the value of the remaining 98% of consumer visits to your online store or brand page.

One can argue that media value of brands's achieved visibility on partner e-commerce properties are comparable to online advertising value metrics. Without going into details and possible attribution models, which most probably will depend on multiple factors, I would argue, much like Doug Stevens, that the value of these media impressions can be both positive and negative. The value of media impressions and total media value your brand accrues on e-commerce properties will be directly dependant on the quality of experience it provides to consumers. Aside of technical aspects (loading times, device compatibility etc.), positive or negative value contribution of media impressions to brand equity, will depend whether they foster or not the communication of unique brand's points-of-differentiation. In simpler terms, if your brand's presence across partner e-commerce is done in a way it fosters the creation & communication of unique points of differentiation it will have a positive effect on your brand equity building. Likewise, if your presence on e-commerce properties doesn't foster communication of unique points of differentiation, it actually has a negative - commoditising effect on your brand and brand equity.

c) Underlying Source of E-commerce Growth Potential

Scalability is a characteristic of a system, model or function that describes its capability to cope and perform well under an increased or expanding workload or scope. A system that scales well will be able to maintain or even increase its level of performance or efficiency even as it is tested by larger and larger operational demands.

.jpg)

Business wise 'growth' means adding resources at the same rate that you’re adding revenue, while 'scaling' means adding revenue at an rapid rate while adding resources at an incremental rate. Digital enabled business models such as e-commerce ones are inherently scalable businesses - they are able to increase revenue (customers) at an exponential rate, while adding necessary resource only at an incremental rate. So, the growth promise of e-commerce is actually a promise of technology enabled scalability, which in turn, is built through technological standardisation.

The growth promise of e-commerce is actually a promise of technology enabled scalability, which in turn, is built through technological standardisation.

To have an e-commerce as a sales channel means to have a technology standardised way of presenting and commercialising products. So, by default, engaging in e-commerce as a sales channel will mean accepting a certain level of standardisation in way your brand is presented and commercialised. From brand equity building perspective, this by itself, or at least in part, isn't a negative thing by itself. Namely, technological standardisation in presenting your brand in e-commerce fosters communication and consumers' understanding of your brand's points-of-parity (POP), which are also an important, but not sufficient, element of brand equity building. For example, your brand on a partner e-commerce property will automatically be placed in a relevant 'folder' or site segment which corresponds to its product category and/or another feature (size, colour, price etc.)

From consumers' perspective this categorisation both increases the quality and reduces cost of search. From brand's perspective the positive upside is that it fosters consumers understanding of your's general brand positioning (eg. that you belong in 'ketchup' category), which may especially be beneficial for new / less known brands or known brands entering new categories. However, as the consumer is not aware how your brand is different from others, nor whether it is worth paying a premium or even full price compared to rest of product category members, the e-commerce categorisation enabled communication of points-of-parity, just by itself, isn't enough for building brand equity nor commanding full or premium price.

As the consumer is not aware how your brand is different from others, nor whether it is worth paying a premium or even full price compared to rest of category members, the e-commerce categorisation enabled communication of points-of-parity, just by itself, isn't enough for positive building brand equity.

Enabler of Full-Price Sales in Partner eCommerce : Brand Digital Retail Experience Design and Strategic Product Assortments

Brand Digital Retail Experience Design as an Enabler of Premium Pricing and Full Price Sales

Partner e-commerce shouldn't be viewed just as an indispensable sales, but also digital media and consumer communication channel. If its media potential is leveraged properly, brand's presence across partner e-commerce properties can become a strong brand equity building tool. Once created through properly communicated POP (points of parity) and more importantly POD (points of differentiation), partner e-commerce digital brand equity will command premium and full price sales. If they don't want to be trapped in a vicious cycle of discounting and commoditisation, digital brand equity creation across e-commerce partner network is inevitable journey on which brands must embark. And rather sooner than later.

Brand digital retail experience design entails transformation of consumer flows into branded experience consumer journey steps

Brands need to acknowledge that sales growth opportunities are indeed there, but question the impact of e-commerce partners and their (lack) capacities / commitment to uphold your unique brand identity. Allowing all the previous years of investments into UNIQUE differentiators in presentation, distribution, and point of sale that set your brand apart from others, go down the drain with eCommerce / eRetail partner/technology standards should not be an option. If some of these need to be forgone for the sake of sales growth, one needs to think how to offset this particular adverse effect on your brand presentation with other (digital) brand amplification points.

Transforming partner e-commerce traffic into a branded experience is done through varying levels and types of digital brand content support.

Brand digital retail experience design is a discipline that merges multiple disciplines in an effort to balance sales optimisation retail space store architecture with brand equity building goals. Translated to digital and partner e-commerce setting, it entails transformation of consumer flows into branded experience consumer journey steps that would foster not only sales, but also creation of (digital) brand equity through consistent communication of your POD (points of differentiation). Transforming partner e-commerce traffic into a branded experience is done through varying levels and types of digital brand content support. In any case, these activities should take both short-term and strategic goals of the brand and a retailer, to create a balance between category goals and retail.com opportunities. The extent of execution will heavily depend on the power relationship between a brand and a retailer and importance a single brand / category has for a 3rd party partner. Digital visions and (mis)alignments are also an important (dis)enabling factor.

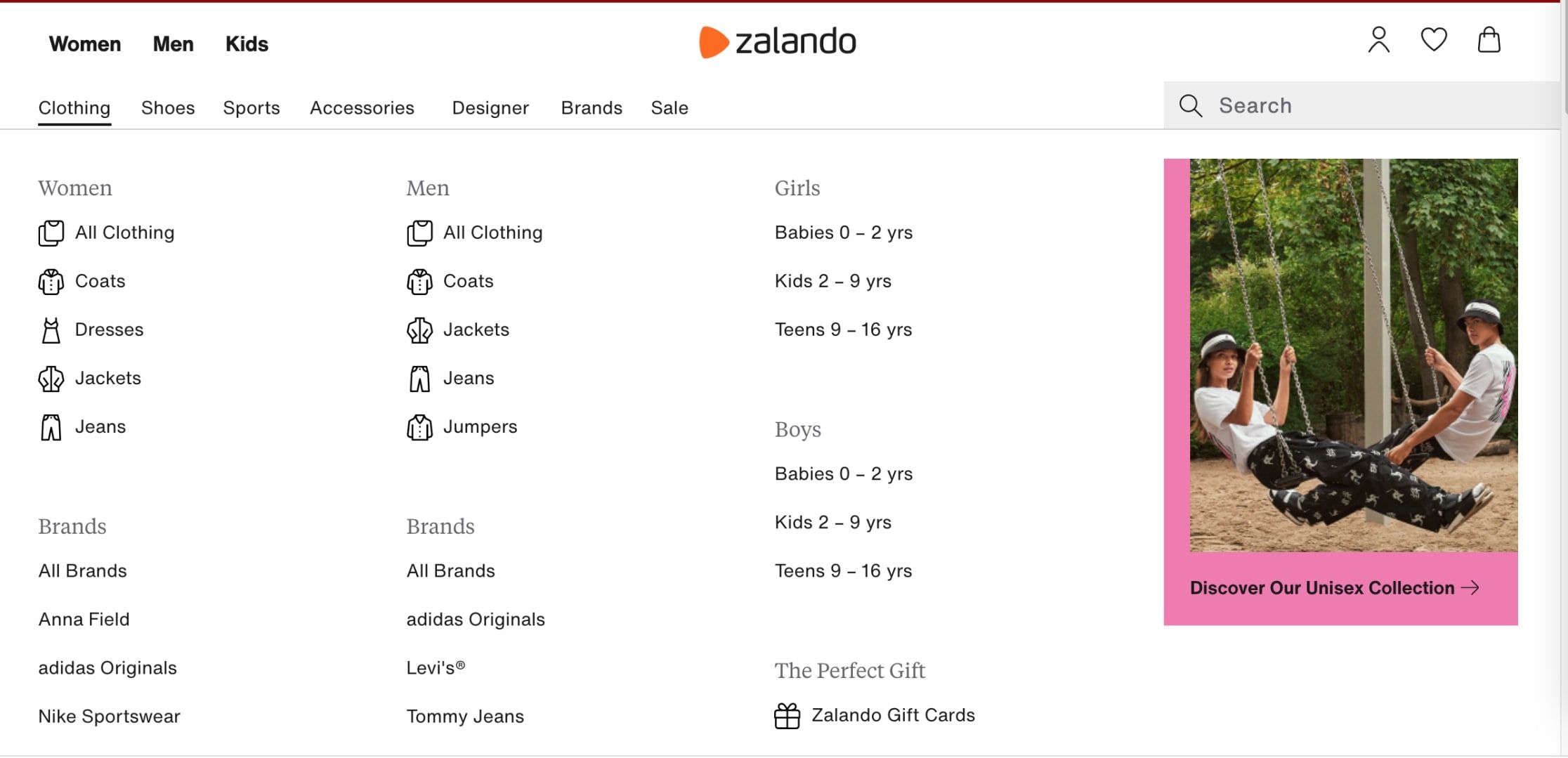

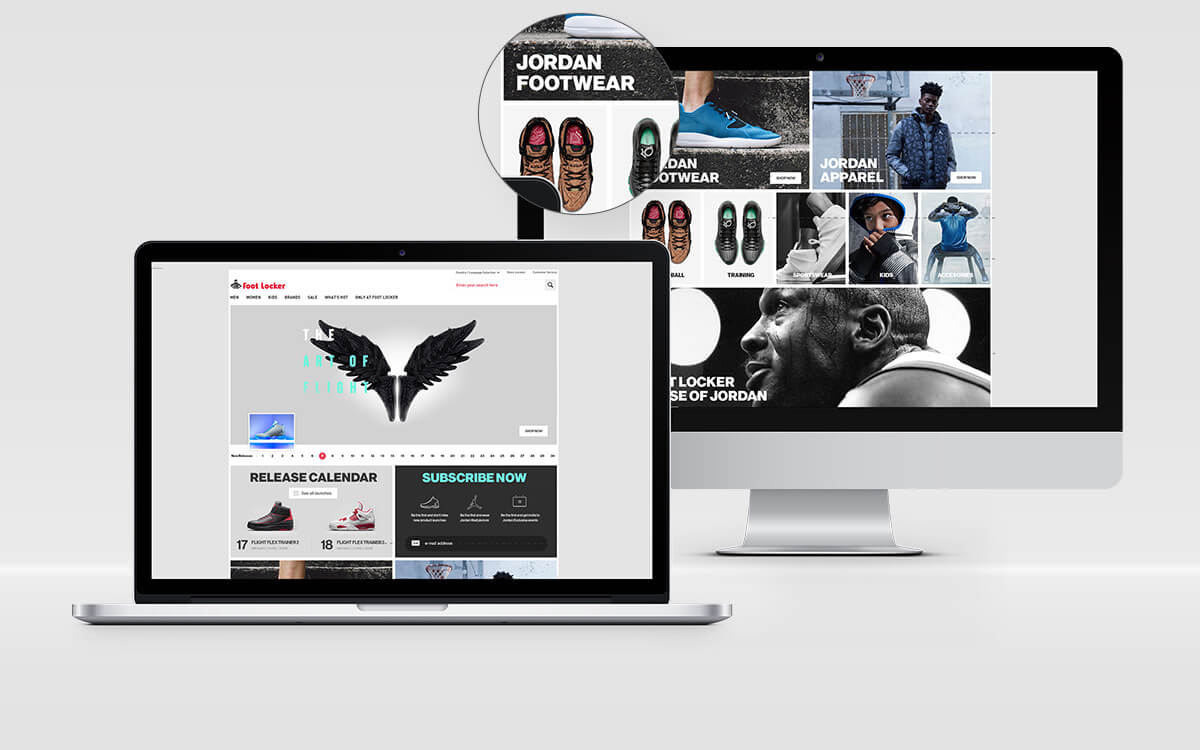

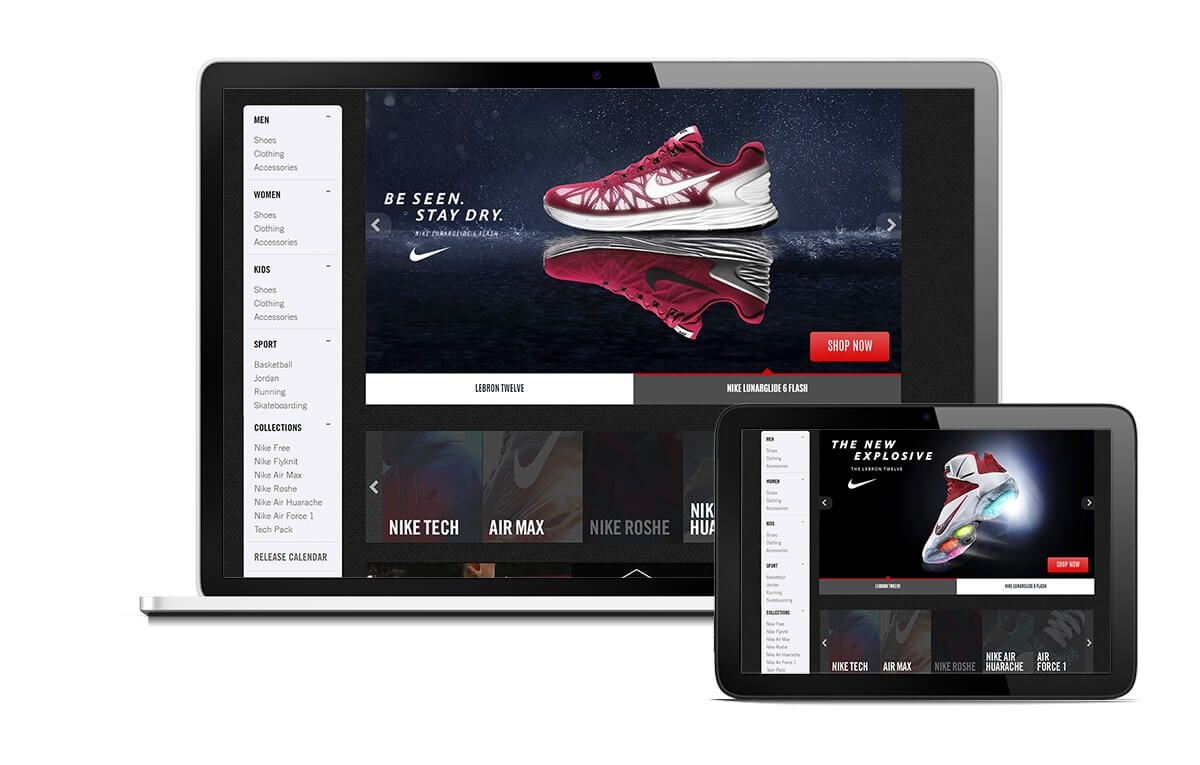

Some of the high-end examples of support, would be bespoke partner e-commerce digital brand experience creations, like ones we've done for Nike EMEA on key accounts like Footlocker.eu, JDsports. These, essentially, not only created unique, distinctively Nike brand retail experiences on partner e-commerce properties, embedded brand into consumer journey experience, but also enabling cross-sells and upsells between (sub)categories.

Brand Elevation in eRetail | Jordan Online Flagship Store on Footlocker. eu designed and developed by SO DIGITAL

Brand Elevation in eRetail | Jordan Online Flagship Store on Footlocker. eu designed and developed by SO DIGITAL

For example, while a retailer may overwhelmingly be able to sell-out the footwear category, for a brand it was important to, leveraging existing traffic, communicate / present / educate consumers about other sub categories - for example accessories of a certain brand - and maximise benefits of the brand investment. Same logic can be applied to even standard branding and content (banners, social, OLM) support. For example the brand / category may have commercial goals to elevate / address women consumers, while the retailer overwhelmingly relies on men. In these cases its convenient to create digital brand presence in form of bespoke digital pages which would marry these goals and tie them up into a coherent consumer shopping experience which aligns strategic goals of both a retailer and a brand.

Brand Elevation in eRetail | Nike Experience Page| Footlocker.eu

Enabling augmented brand experience on 3rd party properties is an inevitable trend fuelled by pressing commercial needs for brands to uphold their core identity, value proposition and pricing.

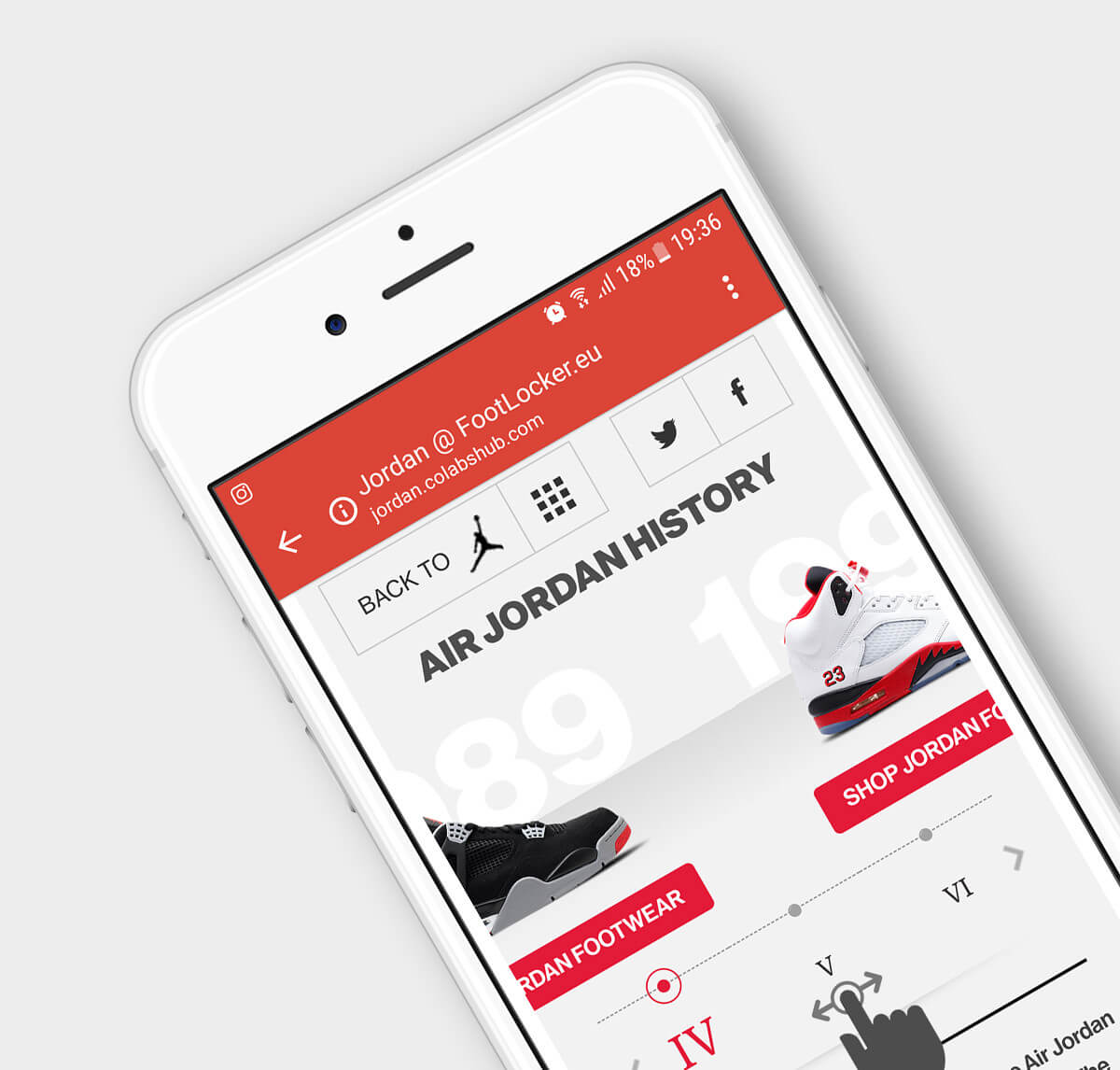

Enabling augmented brand experience on 3rd party properties is an inevitable trend fuelled by pressing commercial needs for brands to uphold their core identity, value proposition and pricing. Even, Amazon, the epiphany of standardisation and brand commoditisation, enabled back in 2017 brand pages, while most recently since August 2020 it includes some of its brand stores in its search.

Asics branded store appearing in Amazon search bar suggestions

Asics branded store appearing in Amazon search bar suggestions

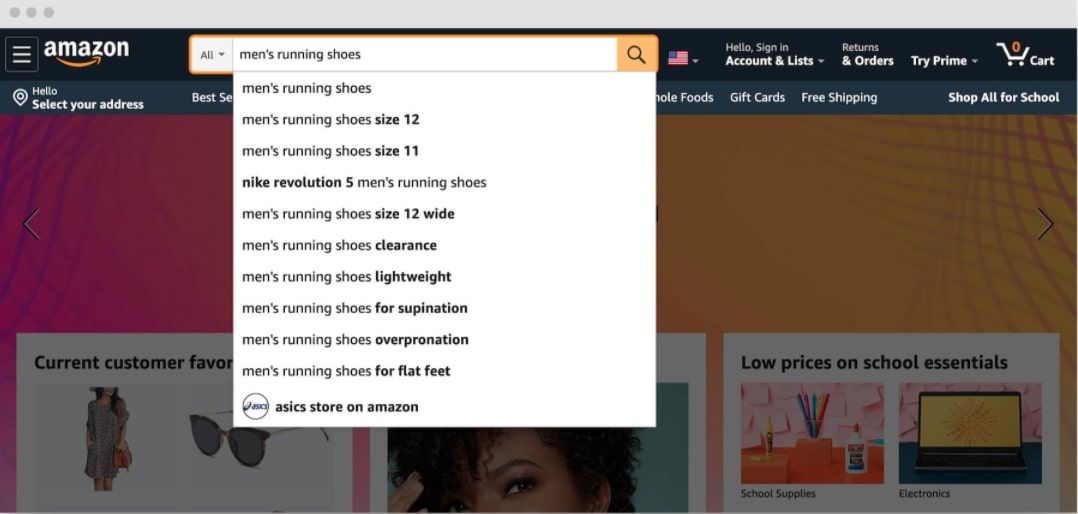

This move not only is immense because of the extra traffic branded stores will be getting, but because of the spillover effect this Amazon's move will have for other online retailers. Perfect example was Zalando which was first was among many that followed suit and started offering brands their own content homepage in October 2020.

.jpg)

An inevitable market trend is evident - 3rd party partner e-commerce is undergoing change to enable more unique brand experience and presence.

In a strong, year long bid, to generate an appeal with luxury industry and brands which have avoided Amazon for reasons of lack of premium look & feel, as well the inability to communicate their brands in a proper way, Amazon took a step further. In 2020 it launched branded experience luxury stores. This invite only digital properties enable brands to custom made their presence and in a more premium way.

.jpeg)

Whether it will be enough to lure more premium brands on its platform remains to be seen, but an inevitable market trend is evident - 3rd party partner e-commerce is undergoing change to enable more unique brand experience and presence.

It was about time.

Category and Product Assortment Strategy and Tactics as an Enablers of Premium Pricing and Full Price Sales

The main tool for profitable and collaborative partner e-commerce channel growth lies in the strategic assessment and management of the category/product assortment across your online partners. At the heart of this approach is the is the strategic matrix of partner vs. consumer vs. assortment which will take into account your retailer partner capability, market share, market segment and served consumer types and match them with your category / product assortments breaking it into demand driving categories such as : Newness / Best Sellers (top half / bottom half), Never out of Stock/ End of life / Discontinued etc.

Strategic approach towards your retailers and your assortment, as well as support services you'll provide to them, will enable optimisation and profit maximisation of your partner e- commerce channel, while making sure brand commoditisation and discounting incentives are muted to highest extent possible.

Most financially successful partners only made available a fraction of their assortment on Amazon

The selective assortment approach towards 3rd party e-commerce partners and specifically Amazon, as an inevitable partner for most if not all brands was found to be at the root of the market success strategy of its oldest if not nascent partners - book publishers. HBR published article brings forward conclusions of careful strategizing of products made available on Amazon by book publishers. The research done by Richard D. Wang and Cameron D. Miller compared publishers’ product offerings in the printed book channel with those on Amazon Kindle during the formative years of the e-book platform (2007–2013). Among other findings, they've concluded that most financially successful partners only made available a fraction of their assortment, reserving their 'crown jewels' for their primary (physical channels). In fact, research found that, 42% of publishers in the research sample withheld their top-selling product category from Kindle. This, alongside with 'acting early' in the partnership evolution, before the network effects kick in, and making retail partnership choices on value creation principle (for own brand) is thought to be one of the crucial elements why physical books and physical book store channels are still a vibrant market. While effects and approaches will vary across industries and categories, this research offers one of the very few actual market data informed insights into successful go-to-market models for 3rd party e-commerce.

How can we help : Partner eCommerce Strategy + Execution

Despite the well argued need for brand amplification on eRetailer's digital properties, very few brands have a structured organisational capacity and knowhow to go beyond the basics of partner e-commerce channel assortment building and brand representation on e-commerce platforms. Enabling global category brand growth across a network of e-retail partners is a matter of strategic vision, sophisticated digital alignment of retailers' and category brand growth plans, and of systematic support capability for digital brand elevation and amplification. Leverage our experience and capabilities in strategy formulation and optimisation to ensure global brand excellence across partner e-commerce.

Taking into account number of your categories and brands, current organisational capabilities, future growth plans, as well as the complexity of the retail partner network, our team will create an digital brand elevation strategy whose purpose will be to ensure long term capability to elevate your brand presence. Output will be the roadmap to the creation of economically sustainable capability to service the needs of your e-retailer partners and your brands. Have questions? Feel free to drop me a line on Linkedin or book a chat with me

References :

New York: Scribner. Knight, Philip H., 1938-, Shoe Dog: A Memoir By the Creator of Nike. New York: Scribner, 2016.

Taylor Peterson, " D2C brands are driving up customer acquisition costs – and it’s time to course-correct". MarketingLand.com : https://marketingland.com/d2c-brands-are-driving-up-customer-acquisition-costs-and-its-time-to-course-correct-264293

Kirsty McGregor, "Is direct-to-consumer the death of wholesale?" DrapersOnline.com https://www.drapersonline.com/companies/is-direct-to-consumer-the-death-of-wholesale

Doug Stephens, "Measuring the Store of the Future", RetailPropeth.com https://www.retailprophet.com/measuring-the-store-of-the-future/

Boris Ziegler, "Partner E-Commerce (eRetail) Pitfalls: Global Brand Commoditisation" so.digital https://so.digital/article/Partner-eCommerce-eRetail-Pitfalls-Global-Brand-Commoditisation

Richard D. Wang and Cameron D. Miller, " How Third-Party Sellers Can Make Amazon Work for Them" HBR.ORG https://hbr.org/2020/07/how-third-party-sellers-can-make-amazon-work-for-them

.jpg)

.jpg)

.jpg)