We help brands drive internal capability, operational and executional improvements to achieve excellence in brand, creative and e-commerce strategy execution. Providing services and solutions across strategy management, internal enablement, capability building and executional support provision.

Flagship clients

(EMEA) 14 markets

(EMEA) 14 markets

(EMEA) 47 markets

(EMEA) 47 markets

(EMEA) 17 markets

(EMEA) 17 markets

(WHQ)

(WHQ)

Keeping brands alive in customer minds means staying continuously present in their feeds, across multiple screens and devices. Digitised path to purchase is paved with digital (brand, creative, product, social, educational) content. Independent whether you're a B2B or B2C company, a Pharma, Tobacco or Apparel & Fashion brand - at the end of the day you need more content. High performing digital sales are impossible without an abundance of high performing digital content both to assist and drive emotional and rational aspects of consumer decision making process.

High performing digital sales are impossible without an abundance of high performing digital content.

Even those brand with physical stores and physical products have become aware that digital content production is a core marketing and business growth capability.

Without any physical products or physical presence, compelling digital content for digital first or digital only brands is of strategic and existential importance. However, as digital interactions overwhelmingly become first and for some only means of consumer interactions, even those brand with physical stores and physical products have become aware that digital content production is a core marketing and business growth capability. Meeting the insatiable content thirst of scrolling feeds and disappearing social media posts, personalised awareness building to conversing driving consumer journey funnelling and post-purchase support was impossible to do within existing marketing organisational models and traditional vendor set-ups which were too slow and too expensive. This was especially true if you were a global brand organisation needing to maintain continuous presence across multiple markets at the same time.

Independent whether you're a B2B or B2C company, a Pharma, Tobacco or Apparel & Fashion brand - at the end of the day you need more content.

.jpg)

The rise of in-housing and internal digital content production factories

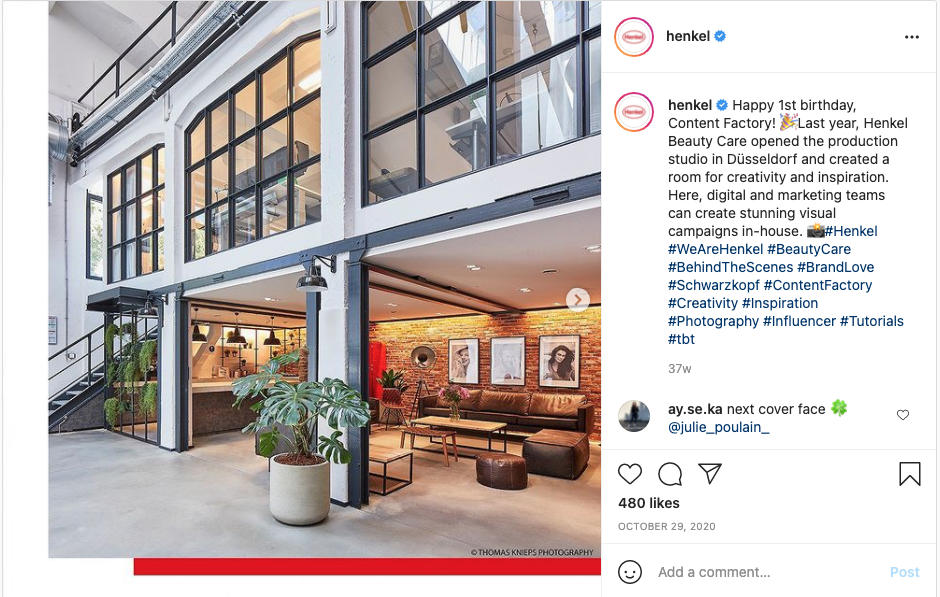

A product launch now requires 10 times more informative content than it did 5 years ago. To handle this growing need, the Grupe Seb, company behind many global brands like Moulinex, Tefal, Krups, Rowenta opened its in-house content factory at the end of 2016. It creates a wide variety of content and can produce anything to help boost sales: photos, product feature spotlights, videos, recipes, manuals, packaging information, and points-of-purchase promotions. Henkel Group, company with broad portfolio of consumer products and brands across hair, body, skin and oral segment, such as Schwarzkopf, Persil, Somat, launched its content factory for the beauty care segment back in 2019 which it plans to ramp up in 2021.

Most if not all global brand organisations today have some type of digital content factory teams - dedicated internal departments which are in charge of large scale production of digital content for sales and marketing. The structure, set-ups and outputs of in-house digital content factories reflect nature of competition within an industry and the go-to-market models of the individual companies. Whereas a global fashion company's in-house digital content factory will focus more on production of inspirational visual content for storytelling, awareness and desire building, a CPG one will focus more on product content - features and comparative benefits as well as legal and administrative compliance (eg. ingredients, allergens).

The structure, set-ups and outputs of in-house digital content factories reflect nature of competition within an industry and the go-to-market models of the individual companies

While B2C oriented companies will staff their content factory teams with designers, photo and video production professionals, B2B companies facing complex organisational buying processes and decision making, digital content factory teams might be more editorial and journalistic. Namely, a food, fashion or jewellery brand doesn't need industry reports, white-papers, case studies or problem identification articles to persuade its potential customers, but for a B2B company this type of content will most likely be a must.

In life sciences industries, such as pharmaceutical or medical devices companies, facing specific path to purchase through healthcare professionals (HCP) who need to prescribe their products and national healthcare organisations who need to approve them, there is a growing need to produce medical content (scientific journals, studies, clinical trials documents) and provide them through digital means. Even though they operate within highly regulated industries, digitisation of consumer attention didn't bypass them, so medical / life science industries and companies are now accelerating their digitisation and optimising digital content supply chains.

While B2C oriented companies will staff their content factory teams with designers, photo and video production professionals, B2B companies facing complex organisational buying processes and decision making, digital content factory teams might be more editorial and journalistic.

Geographical optimisation of in-house digital content production

First generation of in-house digital content factory teams, which were founded in the period from 2015 - 2020, peaking around 2018, were located near to central business premises - global or regional headquarters or digital centres of excellence. As a new venture, facing many unknowns, with high internal visibility and business skepticism, being close to the business management made very much sense. Internal positioning was a key driver as these were still times when top management had to be persuaded to invest into digital capabilities. So, being physically close to them yielded higher chances of funding and businesses willingness to invest. Another benefit was to make sure that digital know-how and digital processes spreads throughout the predominantly non-digital or physical retail culture driven companies and marketeers. Moving the content production in-house, meant taking it away from rooster of traditional agencies. So the cost benefit analysis, cost reduction value now in-housed content production team was bringing to the table, was compared to the cost of external agencies the headquarter teams were working with.

2nd generation of in-house content factory and digital production teams will leverage the global footprint of their organisations and geographically optimise their digital content production and post-production processes

However, as in-house production became the norm, and post-pandemic remote working gives way to distributed global workforce and true remote global collaboration, in-house production agencies and content factories will face next wave of operating model scrutiny and rationalisation. All-in-one place central content production and post-production facilities might be more efficient compared to external traditional vendors, but they fall short of leveraging the true competitive advantage of global brand organisations and global workforce. After all, global brands have been built on "global value chains" - geographic dispersal of the corporate value-adding processes and are intrinsically built on premise of global efficiencies in sourcing, assembly and delivery of value. Sourcing of raw materials happening in one part of the world, assembly in second, sales and marketing in third part of the world, while the distribution of finalised products as well as marketing campaigns and materials is often global with (some) local adaptation aka. "glocalization".

As in-house production became the norm, and post-pandemic remote working gives way to distributed global workforce and true remote global collaboration, in-house production agencies and content factories will face next wave of operating model scrutiny and rationalisation

If a global organisation is built on premises of global value chains, geographically dispersed value-adding process, why would large scale digital content, creative (post)production and marketing content needs be any different.?Why wouldn't there be a more geographically dispersed brand creative content production model that would leverage inherent strength of global brands, their organisations, and footprint?

External incubation of an internal digital content production hub & brand creative implementation factory

2nd generation of in-house content factory and digital production teams will leverage the global footprint of their organisations and geographically optimise their digital content production and post-production processes. Digital content production and post-production is a significant cost element in the marketing budgets. In fact, traditionally, around 20% of marketing (media) budgets is spent on production, while rest is on communication - media buy. As digital ad spend becomes becomes dominant, proliferating digital channels and personalisation opportunities will drive not only media, but also higher digital content production costs.

In-house creative and digital content production teams will need to re-consider and de-construct their production models, identifying high-value strategic projects to retain and focus and low-value, yet labor intensive production and post-production to internally outsource.

With no time to loose, in-house creative and digital content production teams will need to re-consider and de-construct their production models, identifying high-value strategic projects to retain and focus on and low-value, yet labor intensive production and post-production to internally outsource.

With already (at least one) in-house agency and production team under their belt, higher awareness of further global creative production optimisation opportunities, brand organisations can use already established models to recreate internally outsourced digital brand implementation hubs and digital content factories in lower-cost countries.

Global creative implementation and trans-creation agencies have been leveraging global creative workforce for years. With already (at least one) in-house agency and production team under their belt, higher awareness of further global production optimisation opportunities, brand organisations can use already established models to recreate internally outsourced digital brand implementation hubs and digital content factories in lower-cost countries. While in-house creative teams would focus on strategically creative project, these digital production hubs and post-production facilities would focus on volume. As there's no reason for them to be close to the business nor headquarter facilities, rather where its most efficient for them to be, best locations would be determined by factors of talent pool and operating costs. Taking into speed-to-market, it would make most sense to hire an experienced external vendor to quickly set-up and initially operate the future in-house team digital brand content production team with the ultimate goal of corporate internalisation once its fully operational.

External incubation of a future in-house digital brand content production factory team located at a lower cost country would leverage best elements of all operating models in the marketing production ecosystem

External incubation of a future in-house digital brand content production factory team located at lower cost country would leverage best elements of all operating models in the marketing production ecosystem : internal know-how and closeness to the business of in-house agencies, geographical cost optimisation brand implementation and trans-creation agencies access to global talent, agility and new venture risk mitigation of external vendor agency in initial set-up and operation.

Mapping out the road to success

There are number of considerations to take into account when looking to geographically optimise the costs in-house digital brand content production. Like with any new venture there should be a defined purpose of value the newly incubated team would be brining in, short, mid and long term vision how success should look like. A realistic timeline and key stakeholders should also be identified, while keeping in mind that once operational, the remote creative content factory team will entail a change management of internal creative production operations. Key success factors are right locations, right people and right partners to execute the geographical rationalisation of in-house creative production costs. Iterating on small-scale successes is the best way to achieving organisational excellence in optimised global creative production. Interested to learn about the details be sure to read our article : Setting Up and Operating an Internal Remote (Lower Cost Country) Brand Creative Content Factory Team & Digital Production Hub

.jpg)

In a 2019 Campaign magazine article, devoted to rise in off-shoring, Julie Loaiza, VP of communications and corporate affairs at Nestlé Mexico confirms that this model (done with external vendors) has delivered up to 80% of costs saving in marketing production. "Today, we focus on brand, marketing and E-business strategies that, from the very start, consider off-shoring as a fundamental channel to achieve marketing production efficiencies, especially when considering the benefits of cost, creative and time execution" In 2018, Nestlé saw a 43 percent savings in digital content production for Nestle Infant Nutrition compared to the year before, and a whopping 80 percent savings in video production of Nestlé Recipes with culinary brands, said Loaiza

In 2018, Nestlé saw a 43 percent savings in digital content production for Nestle Infant Nutrition compared to the year before, and a whopping 80 percent savings in video production of Nestlé Recipes with culinary brands

"The offshore model, processes and methods of execution have been modified and adapted," she explained. "There is no standardised way to do it, but that is the beauty of off-shoring, it adapts easily as our organisation evolves."

A 2021 Benchmark Report on Delivering Offshore Success found that the US and European offshore creative production market has matured. Offshoring services has become essential for agencies to stay competitive, to access flexible resource and produce content at scale. Offshore creative production is now part of the solution to the above challenges. Reinforced by the fact that 76% of agencies surveyed currently offshore some level of creative production. Generally, services which are most efficiently sent offshore are those which are repetitive, have clear guidelines and standards such as:

Artwork & retouching

Content localisation (social, digital & video)

PowerPoint & financial reports

Short form video & motion graphics

Post-production

Animation & CGI

Web/app development

Which companies use lower cost countries to geographically optimise the costs of in-house content production?

Examples of using global workforce and global footprint of their organisations to reduce costs of content production can be found across all industries. Pharma industry - GSK Consumer Healthcare has in 2020 spearheaded creation of global digital production hub based in India, with addition of supporting regional hubs in charge of global content adaptation and mission to serve regional markets faster - with more effective and efficient content. For example, its Emerging Markets Content Hub is based in Istanbul, Turkey. GSK leveraged external partners which helped it plan for end-to-end content production performance across the global markets.

Gambling & Casino industry is a no stranger to geographical optimisation of operations. Because of legal compliance, gambling companies often have their financial & legal operations headquartered in remote jurisdictions. When it comes to brand creative and in-house content production, Stars Group , housing brands like PokerStars, PokerStars Casino, BetStars etc. created global creative production capabilities across 4 locations, main - London based in-house creative production studio, but also remote lower costs country based production studios in Bulgaria and Colombia.

How can we help?

In case you're looking for ways to reduce costs of creative content production and are open to leveraging capability multiplier potential of remote creative teams and digital decoupling we'd love to talk to you and see whether some of our experience in rationalising global-to-local brand & creative content operations for clients like Nike EMEA and Uber EMEA. Reconfiguring how global-to-local brand marketing is done through implementation of process driven technology workflow solutions and geographical optimization of digital brand marketing production, we were able to save clients like Nike EMEA and Uber EMEA millions of euros in marketing costs.

SO DIGITAL focuses on cost & operational rationalisation of global brand's go-to-market operations. We've worked with some of the leading global brands such as Nike EMEA (14 WE markets) and Uber EMEA (47 EMEA markets)

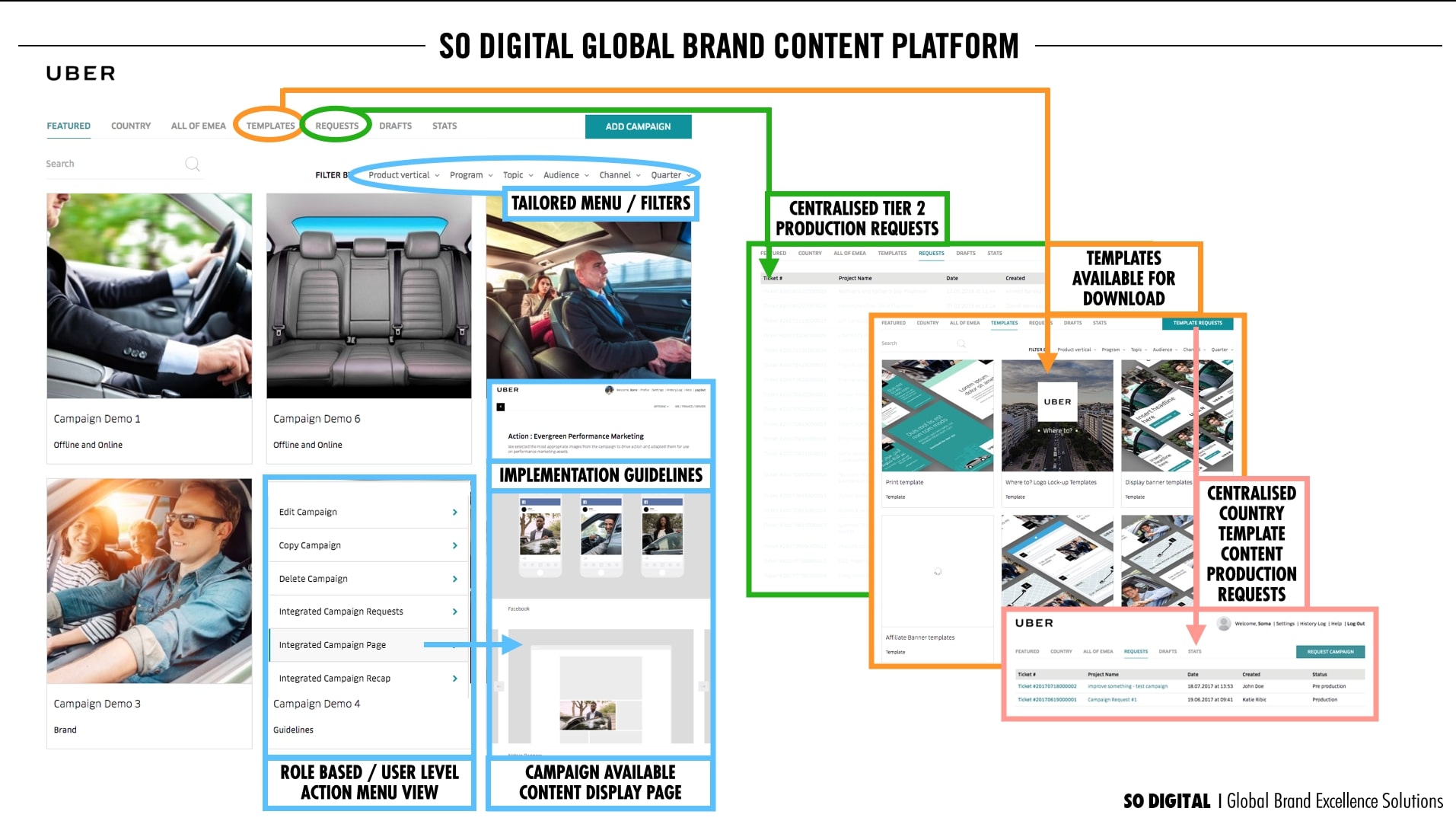

Nike EMEA stakeholder was wholesale. com brand digital team and our role involved digital enablement of tiered brand marketing & campaign content support strategy towards a complex network of e-retail partners across 14 WE countries and implementation rationalisation of seasonal brand (launch) activations for 10 categories. Uber EMEA case stakeholder was in-house brand creative / marketing agency and our role was streamlining go-to-market operations when it comes to marketing & creative content support of 47 EMEA countries based ( x time city teams) growth marketeers.

For both of these flagship clients scope involved :

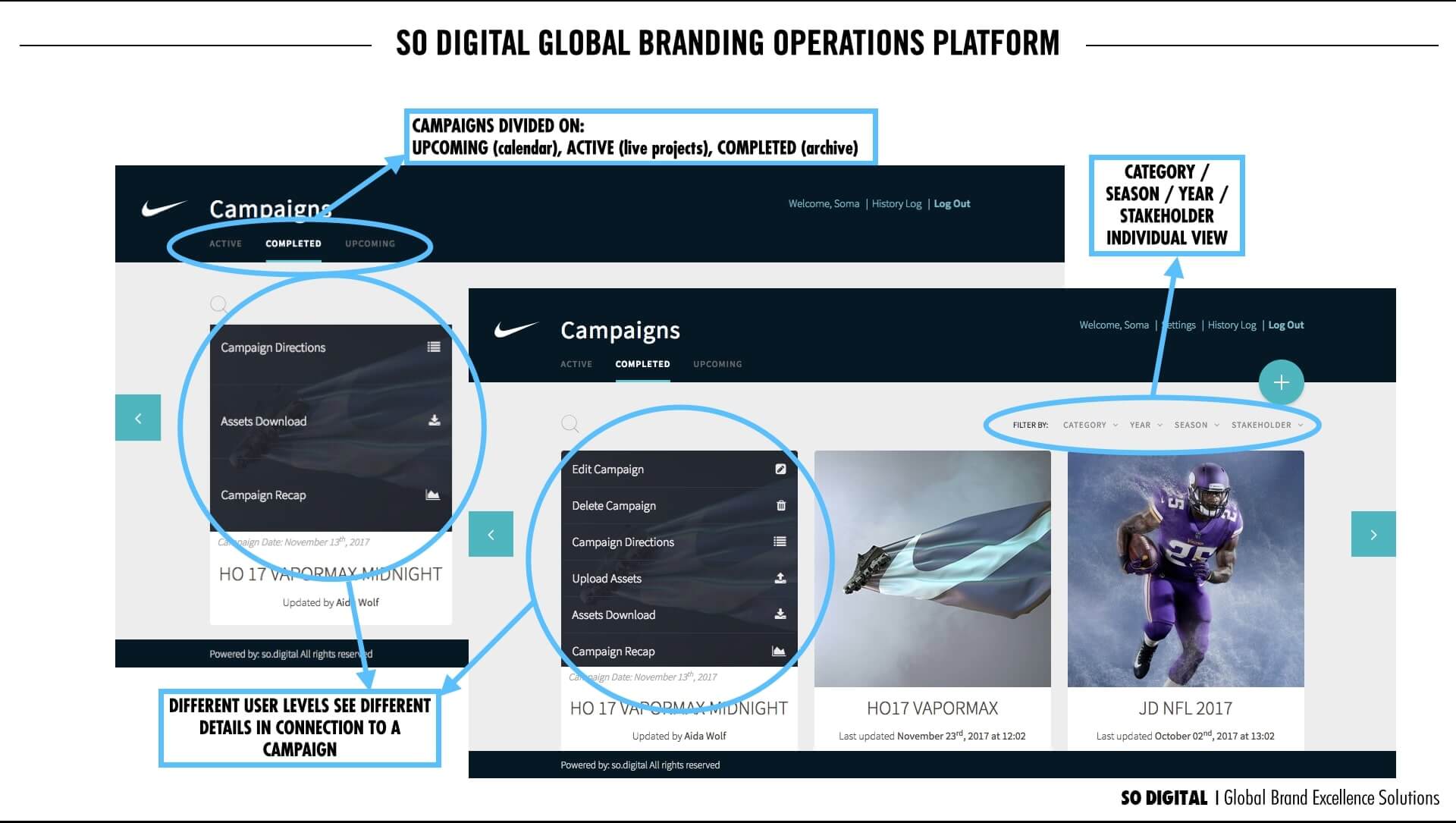

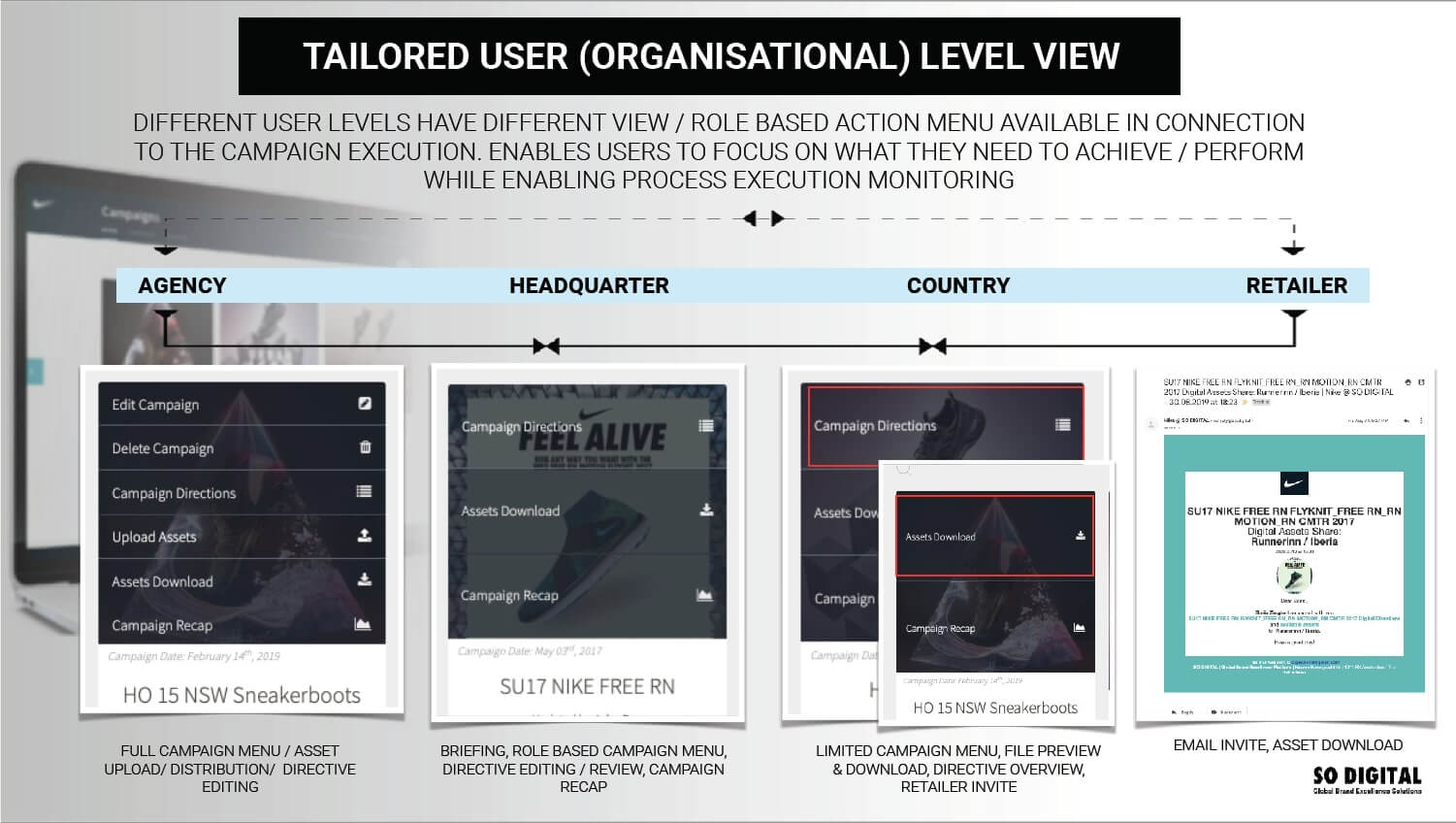

1) creation of tailored made platform solution which rationalised and digitised digital brand management, activations & campaign content operations between HQs and country teams (local units/ 3rd party retail partners) & solved many operational issues present.

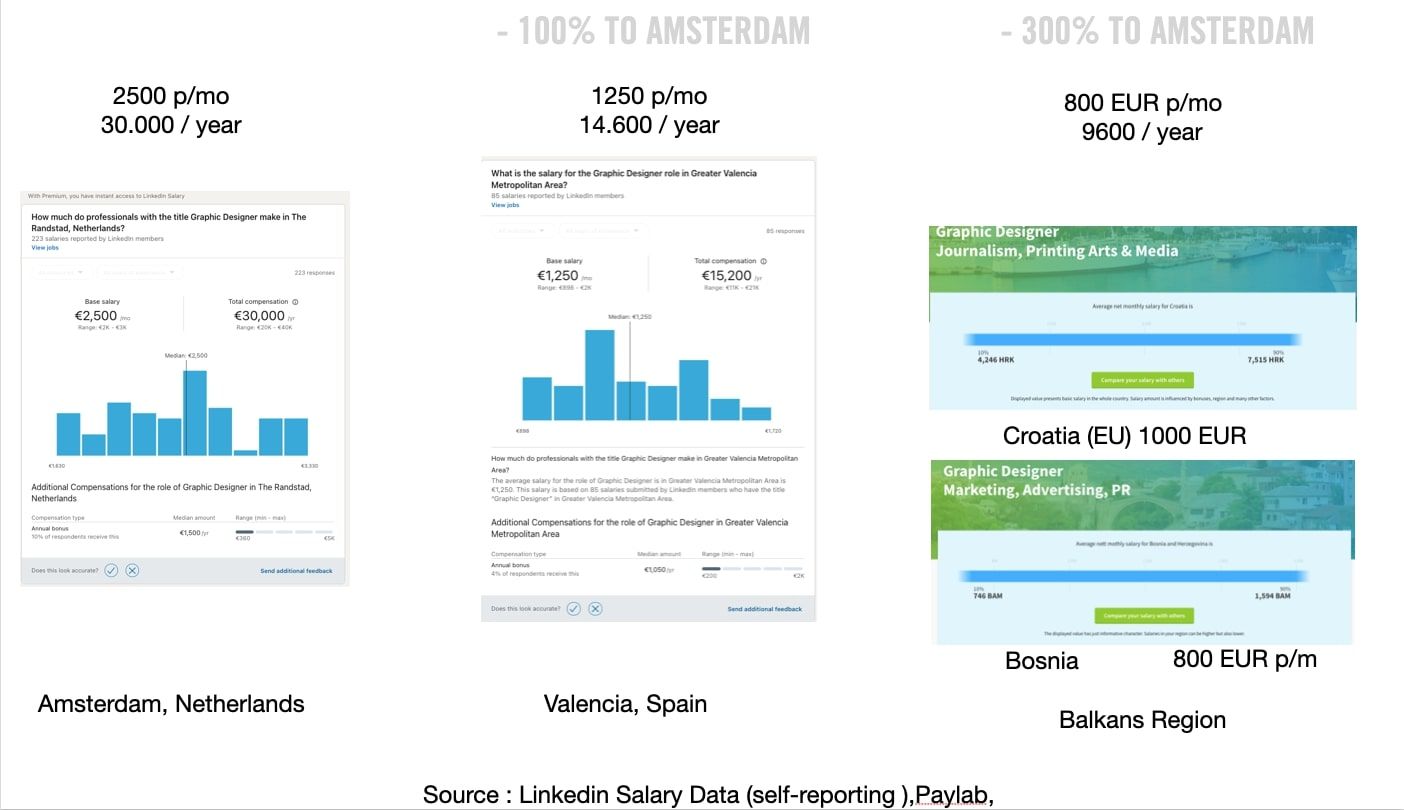

2) creation of a remote digital brand content factory placed at a lower cost countries, which produced large volumes of premium digital brand marketing campaign content, e-commerce content, while providing support for tiered 2, tier 3 requests and web / application development support. We've set up & operated 3 production hubs in Balkans region (Croatia, Bosnia & Herzegovina, Serbia) while providing face2face client service in Amsterdam and supporting talent (unavailable in Balkans region) form other cities such as Berlin and Barcelona.

Geographical cost optimisation potential for position of a "Graphic Designer" is between 100 - 300% in 2021 between Amsterdam, Valencia and Balkan countries.

So rationalisation was done both through process & resource side of content operations.

- CLIENT CASE ACCESS

References :

Oliver McAteer, "A rise in off-shoring: How Nestlé slashed production costs by as much as 80%" https://www.campaignlive.com/article/rise-off-shoring-nestle-slashed-production-costs-80/1585494

"Digital Decoupling A Capability Multiplier in the Marketing Equation", Accenture, https://www.bl.uk/business-and-management/collection-items/suppressed-by-publisher/accenture/digital-decoupling-a-capability-multiplier-in-the-marketing-equation

Decoupling Global Digital Marketing Services, Lionbridge https://info.lionbridge.com/Decoupling-Global-Digital-Marketing-Gated-EN-GB.html?utm_source=linkedin-shared&utm_medium=social&utm_campaign=Lionbridge-Decoupling-Digital-Marketing-ebook-uk&utm_content=marketing-track-uk

Emma Charlton, "Where labour costs the most (and least) in the European Union", World Economic Forum, https://www.weforum.org/agenda/2019/05/chart-labour-costs-in-european-union/

Saskia Johnson, "What creative production services are most suited to offshoring and how do I plan for success" https://www.weareamnet.com/what-creative-production-services-are-most-suited-to-offshoring-and-how-do-i-plan-for-success/