We help brands drive internal capability, operational and executional improvements to achieve excellence in brand, creative and e-commerce strategy execution. Providing services and solutions across strategy management, internal enablement, capability building and executional support provision.

Flagship clients

(EMEA) 14 markets

(EMEA) 14 markets

(EMEA) 47 markets

(EMEA) 47 markets

(EMEA) 17 markets

(EMEA) 17 markets

(WHQ)

(WHQ)

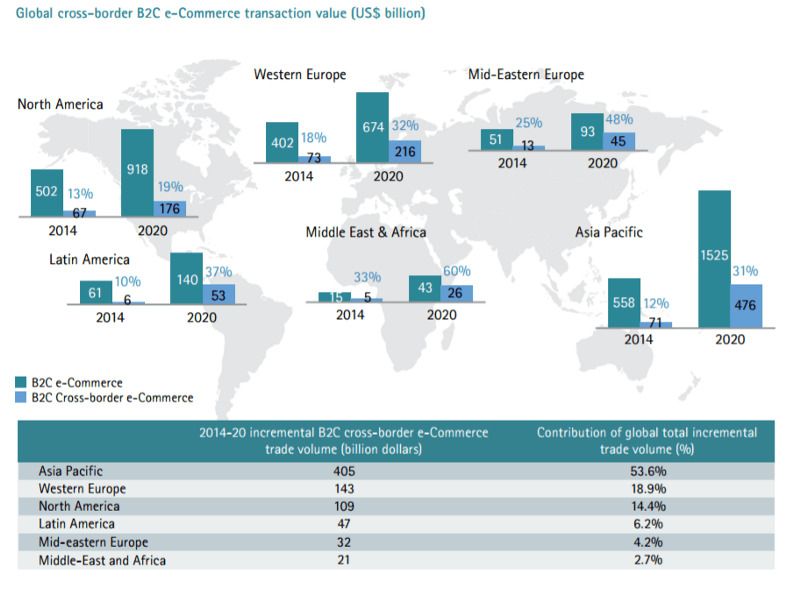

While domestic online sales in the United States and the European Union will continue to increase — taking sales away from brick-and-mortar stores — growth rates will flatten out over the next 10 years. The most explosive growth will be in worldwide cross-border e-commerce, with the Asia Pacific region leading the way. According to Accenture, by 2020, over 2 billion e-shoppers, or 60 percent of target global population, would be transacting 13.5 percent of their overall retail consumptions online, equivalent to a market value of US$3.4 trillion (Global B2C GMV, growing at CAGR of 13.5 percent from 2014 to 2020).

Fuelled by emerging markets and convergence of consumer and market trends, cross-border e-commerce will be a key growth engine for the global e-commerce industry. As in the last few years growth rates have begun to slow in mature markets retailers have had to look beyond their borders to find sustainable opportunities that allow them to meet growth targets. To drive global growth and meet growth targets in today’s competitive marketplace, retailers and brands have started to think about international expansion through leveraging the strength of eCommerce into new markets. Riding the wave of cross-border consumer purchases phenomenon, retailers and brands have realised that they need growth strategies that will capitalise on this market trend development.

Cross-border e-commerce carries one very significant challenge - distinct market consumer purchase habits that vary from country to country. Failing or meeting it will define your growth prospects.

While cross border e-commerce is here to stay and needs to be considered accordingly as a growth strategy for an e-commerce business, it carries one very significant challenge - distinct market consumer purchase habits that vary from country to country. Failing or meeting this challenge will define your cross-border e-commerce growth prospects.

Country Distinct Consumer (Post)Purchase Preferences

Buying habits are tendencies customers have when purchasing products and services. These tendencies come from a variety of different factors and aligning with or against them will have significant impact on your sales prospects as customers will feel comfortable or uncomfortable buying from you. For a global e-commerce growth perspective it is important to realise that with a change in country and culture, purchase habits also change. Market by market country distinct consumer purchase habits are not just naturally determined by country culture differences, but when it comes to e-commerce buying habits also by market maturity in terms of technological level of advancement and e-commerce industry maturity but also by already existing local players. Talking about the purchase habits one needs to know that out of 3 phases of purchase experience (pre-purchase, purchase and post-purchase) it is the post-purchase that carries most weight when defining positive or negative evaluation of the total buying experience. Thus, when looking across country distinct e-commerce purchasing preferences, one needs to pay special attention to the post-purchase phase.

Ignoring the country distinct e-commerce (post)purchase preferences when formulating and executing cross-border e-commerce growth strategies means setting them up for failure. This is where we arrive at the problem that many global retailers and global brands face - how to take into account the country distinct (post)purchase preferences in cross-border e-commerce?

Ignoring the country distinct (post)purchase preferences when formulating and executing cross-border e-commerce growth strategies means setting them up for failure.

Ignorance is NOT bliss : avoiding cross-border e-commerce growth pitfalls

The length of delivery time, variety of delivery options, tracking visibility and communications, how your product is packaged, the ease of exchanges and returns—it all contributes to e-commerce post-purchase experience. Aligning or misaligning with country distinct preferences across these dimension will mean you win or lose in cross-border e-commerce. Unfortunately, e-commerce, supply chain, marketing, brand and CX management professionals’ ability to successfully formulate, execute and optimise e-commerce growth strategies is hampered by the lack of continuous access to insights into market implicit customer expectations from an e-commerce shopping experience. Disabled by lack of systematic assessment insight into it’s competitive position and dynamics of competition within and across markets, global e-commerce & brand professionals risk making faulty market steps and costly mistakes by applying “one-size-fits-all” approach which ignores country distinct consumer preferences shaped by e-commerce market maturity and local players.

Global e-commerce & brand professionals risk making faulty market steps and costly mistakes by applying “one-size-fits-all” approach which ignores country distinct consumer preferences shaped by e-commerce market maturity and local players.

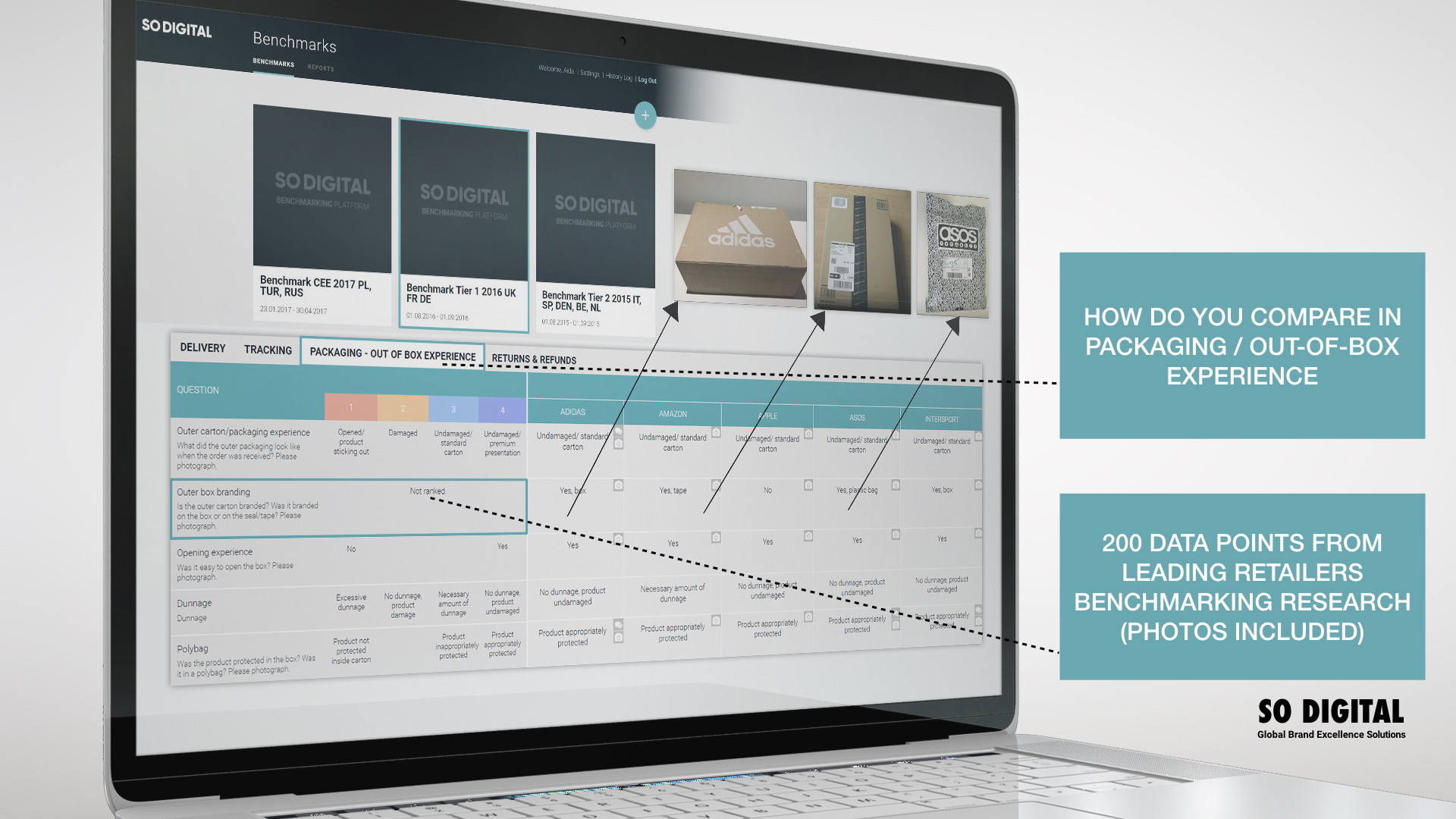

SO DIGITAL GLOBAL E-COMMERCE BRAND EXCELLENCE PLATFORM is a management tool that helps companies formulate, evaluate, and improve their e-commerce strategies by providing a systematic assessment of competitive performance of post-purchase experience across markets. Our platform enables competitive cross industry performance benchmarking of best performing e-retailers across dimensions of online (post)purchase experience, including but not limited to, phases of delivery, tracking, packaging - out of box experience, and return & refunds.

Market benchmarking results can be compiled into user made customisable reports - per dimension of shopping experience, data point, retailer, country etc. to enable market (average) performance comparison and learning insights. These invaluable insights reveal market by market preferences and can guide your cross-border growth strategies.

Facilitate cross-border e-commerce growth and new market business development by uncovering success sources of best performing e-retailers within an individual market, contact us today for a no-commitment one-on-one free walk through of the solution & service and client use case of Nike (EMEA).

---------------------------------------------------------------------------------------------------------------

SO DIGITAL | GLOBAL BRAND EXCELLENCE SOLUTIONS is a technology company based in Amsterdam specialised in serving headquarters of global brands. We are proud partners of leading global digital growth brands like Nike (EMEA) and Uber (EMEA), but also other brands like TomTom (WHQ) and AS Monaco. With offices in Amsterdam, Berlin, Barcelona and Balkans we help global brands reduce complexity cost of global branding by delivering speed, scale and efficiency in execution across markets.